File this under “Not Too Shocking,” but it’s still something to keep an eye on, and an issue many companies have a huge stake in. Wireless carriers are facing a data crunch in which they must convince customers to either use less data, or pay more for the data they do use. It’s a tricky battle that pits cost and profit against competition and customer satisfaction and loyalty. Some companies, like Republic Wireless, think they have a way around that by forcing customers to rely on wi-fi in exchange for cheap unlimited plans, but that’s mainly targeted toward consumers and would be largely unrealistic for workers in the field who don’t have access to wi-fi. This issue will reach a boiling point in the near future. Keep an eye on it.

File this under “Not Too Shocking,” but it’s still something to keep an eye on, and an issue many companies have a huge stake in. Wireless carriers are facing a data crunch in which they must convince customers to either use less data, or pay more for the data they do use. It’s a tricky battle that pits cost and profit against competition and customer satisfaction and loyalty. Some companies, like Republic Wireless, think they have a way around that by forcing customers to rely on wi-fi in exchange for cheap unlimited plans, but that’s mainly targeted toward consumers and would be largely unrealistic for workers in the field who don’t have access to wi-fi. This issue will reach a boiling point in the near future. Keep an eye on it.

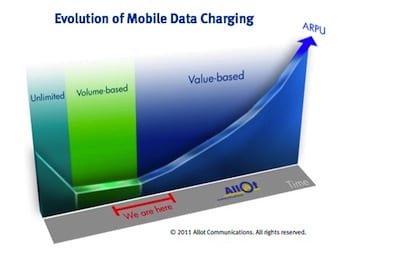

Carriers desperately seeking higher mobile data prices

It’s tough out there for carriers. After years of charging people 25 cents to sent a few kilobytes of data via text messaging, they’re suddenly dealing with folks that want to watch YouTube videos on their mobile phones and pay a mere $50 for an unlimited plan. The economics don’t work, and as proof we only have to look at the death of the unlimited plan.

Today only 13.5 percent of operators offer a “true” unlimited plan, while 25 percent offer an unlimited plan in name only (but with caveats such as throttling or even an undisclosed cap), according to data gathered by Allot Communications, a network optimization vendor. Allot surveyed 100 operators to discover how they price mobile broadband and discovered about 80 percent had already moved to some form of volume-based pricing (think buckets of bytes) while 35 percent were trying to charge based on the applications used. The percentages don’t add up because some operators offer both types of plans.

Read the whole article at GigaOm.

Share this: