Today we are seeing a pivot in service models across all industries. Medical device, which is largely product-focused, is being challenged to shift their model beyond product and more into outcome-based technology solutions that go well beyond the older break-fix way of thinking.

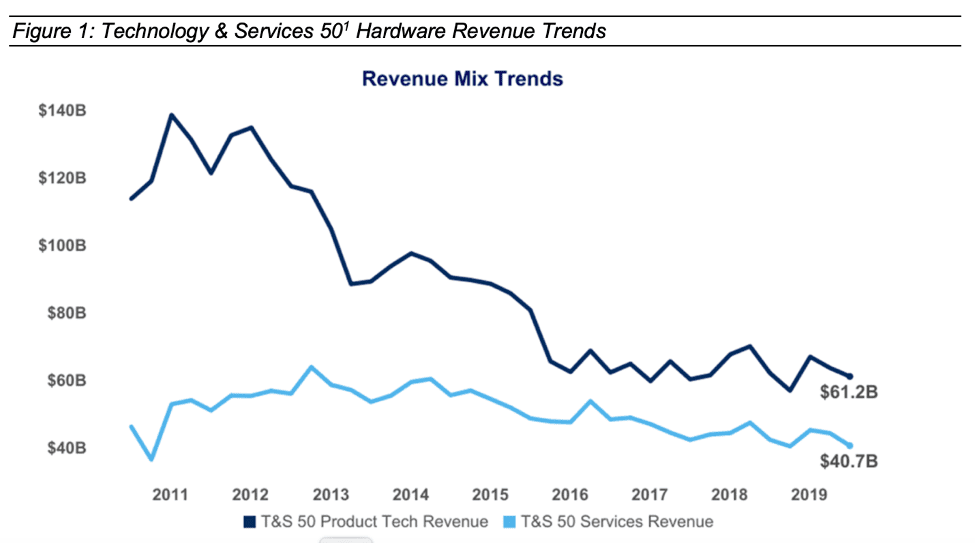

The business model that was once regarded in the neighborhood of $140B in 2011 has seen a consistent downward spiral. It’s currently sitting at an estimated $61B—a decline of roughly 44% over the past nine years. This decline has begun to compress and disrupt the service market forcing these organizations to rethink their strategy.

One of the bets that some manufactures are putting stock in is that as the technology increases in complexity and more products are released, this will, in turn, continue to make up for the revenue dip in services by increasing the demand for support.

Those more complex systems also come with more nice-to-haves and bells and whistles, but those new features don’t necessarily gain the stickiness needed to help drive incremental sales to the point where the revenue is bridging that revenue gap. This is also known as the consumption gap. Another drawback to this is that customers are expecting to have their new highly complex products supported for less. This pressure from the customer is also pushing the manufacturer to have to respond differently in their service model as it doesn’t only cause top-line erosion but also can begin impacting the business’s profitability. More complex products and higher cost to serve models along with pressure to keep the cost of entitlements down will drive down the profitability of the service business.

Transformation to an Outcome-Based Service Model

In order for MedTech companies to bend this curve and begin regaining momentum in driving profitable revenue, they need to create both differentiated service offerings and value-added outcome-based solutions. The days of the customer owning all the risk are over, and there is a new appetite for shared risk offerings. A few of these outcome-based solutions are as follows:

- Predictive Services/Analytics

- Asset Management and Optimization with cost out commitments

- Digital Connectivity driving enhances in Clinical Outcomes

- Core and Multi-Vendor Support

The key for all MedTech businesses is to understand the outcomes that their customers need to deliver and then to build solutions that will enhance those outcomes. Once that recipe is created, the manufacturer can shift from being solely a product-based business to selling outcome-based solutions at the time of sale of the capital equipment. The dynamic shift will enable the business to sell premium level outcomes at a premium price to the customer. The customer’s appetite is heathy for these solutions as they are allowing them to enhance the outcomes for their customers, hence a shared risk, and shared reward.

The second key to building out these value-added solutions is to do so with cost in mind. The objective is enabling the technology and operations to manage and deliver those outcome solutions for their customers while doing it as a marginal cost. This optimizes the bottom-line contribution from selling these premium level solutions. The goal is not only to drive top-line growth but to also bend the curve in improving the eroding margins.

This is where you see the investment trend towards digital applications focused on:

- Asset Centric SaaS platforms such as ServiceMax’s Asset 360

- Data Warehouse or Data Lake (certified data sets and single source of truth)

- E-Commerce

- Customer Self-Serve Portals

- Process Automation

- Predictive capabilities through AI and IoT

- R&D-driven machine onboard AI, Sensory, and IoT capabilities

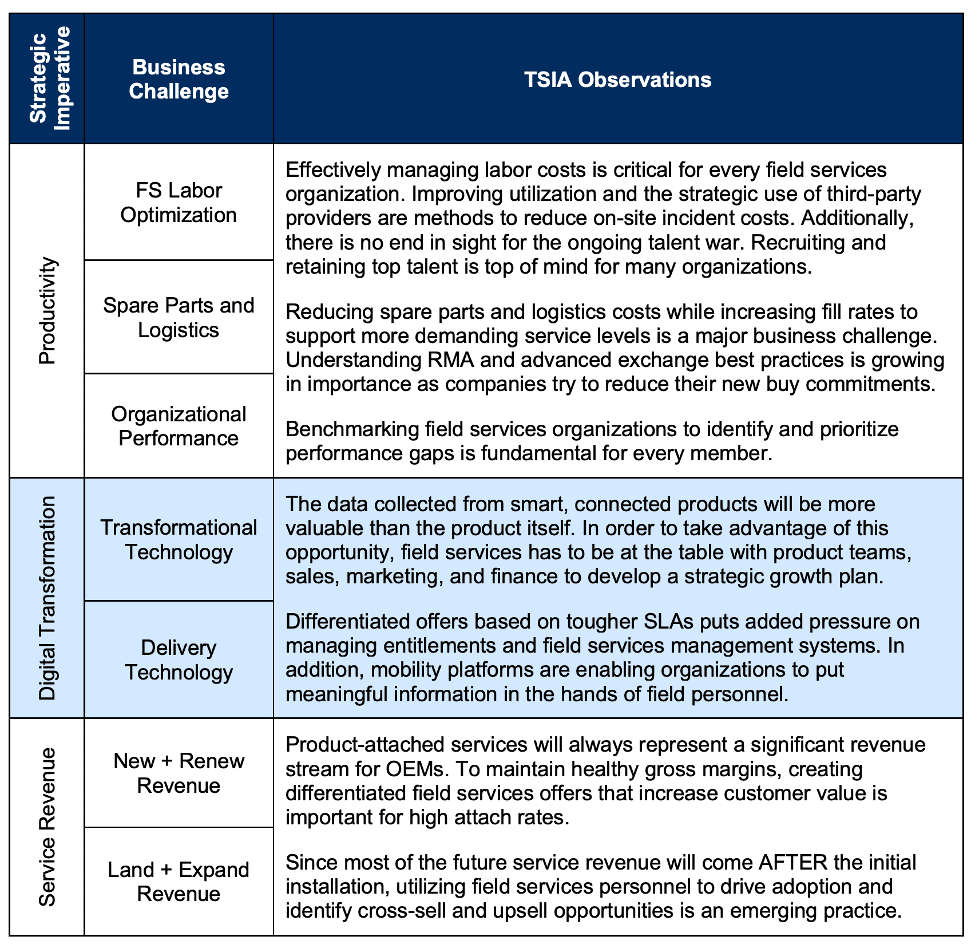

The above digital investments are needed to ensure the outcome-based solutions are enriched and can be managed to optimize the successful outcomes. Optimizing the reward and reducing the risk will allow the manufacturer and the customer to be successful. TSIA published the below chart that succinctly articulates the digital transformation needs to drive successful outcome-based solutions. One of the keys to the transformation is that it’s not just a service strategy, but instead a complete horizontal strategy across the business. This is a crucial learning if you are to truly develop a successful value-added solution for your customer. It takes a holistic approach for this to be executed successfully.

This is the journey we are on in the MedTech industry, and this extends to other industries as well. This pivot in service models is critical in MedTech and the Industrial markets. If organizations in the industry are to reignite their financial performance and reach new heights of growth, they must change their strategic mindset and business model.

Stay tuned for the next article where we focus on workforce optimization and productivity trends in the MedTech space.

Learn more about ServiceMax’s Asset 360 for Salesforce Field Service here.

Share this: