We’ve all by now heard the reports about Apple’s monster 2011 — its stock is trading above $500 a share right now — and that success is bolstering statistics that show that smartphones and tablet computers like its iPhone and iPad are actually outselling desktop, laptop, and netbook personal computers combined over the last fiscal quarter.

But can they keep it up? Will a Windows 8 operating system release convince a few enterprise businesses to embrace ultrabooks? And why are tablets and smartphone sales rising together, instead of competing with each other? Mobile Enterprise’s Tony Rizzo breaks down the state of affairs in mobile device sales.

Article excerpted with permission. Click here to read the full story.

Tablets and Smartphone Sales Dominate PCs in 2011

In its most recently reported quarter, Apple mobile devices — which are full-fledged computing platforms — outsold Hewlett-Packard’s entire PC lineup. That Apple outsold HP is noteworthy in and of itself. It turns out that there is even more to tell here when it comes to the overall sales figures of mobile device computing platforms vs. sales of traditional PCs. According to just-released Canalys research, total Q4 2011 estimated global shipments of smartphones to clients exceeded those of client PCs for the first time.

In its most recently reported quarter, Apple mobile devices — which are full-fledged computing platforms — outsold Hewlett-Packard’s entire PC lineup. That Apple outsold HP is noteworthy in and of itself. It turns out that there is even more to tell here when it comes to the overall sales figures of mobile device computing platforms vs. sales of traditional PCs. According to just-released Canalys research, total Q4 2011 estimated global shipments of smartphones to clients exceeded those of client PCs for the first time.

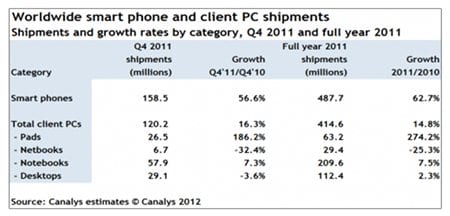

Unlike in Apple’s case, where the comparison was made based on the combined shipments of iPhones and iPads vs. HP’s PC shipments, the Canalys research groups tablets and PCs together, making the sale of smartphones an unprecedented occurrence with implications for significant ongoing smartphone penetration, especially in the enterprise. The chart below provides details of these shipments. 158.5 million smartphones were shipped in Q4 2011, a significant 57 percent increase on the 101.2 million units that were shipped a year earlier, in Q4 2010. Total global shipments for the entire year surged to 487.7 million devices, up a whopping 63 percent on the 299.7 million smart phones shipped throughout 2010. By comparison, the global client PC market grew 15 percent in 2011 to 414.6 million units. PC growth was essentially stagnant, but the 274 percent growth in tablet shipments, which accounted for 15 percent of all client PC shipments in 2011, brought the total number up.

The huge increase in tablet demand comes at the expense of traditional PC hardware — with desktops, notebooks and netbooks all taking hits in terms of rate of units shipped. That isn’t surprising, and we can anticipate the trend continuing. An interesting question arises based on these numbers: will ultrabook shipments based on Windows 8 and the Metro UI shift the dynamics away from tablet growth in the enterprise? Intel and a number of its ultrabook partners are certainly betting on this. It will be very interesting to see if tablet shipments continue to build enormous momentum, and if that momentum will kill ultrabook sales down the road.

Click here for the full story from Mobile Enterprise.

Share this: