It’s been several years since the official end of the Great Recession, and we finally see organizations beginning to switch from a cautionary mindset to one of business expansion. However, business and revenue expansion initiatives need to be built on an infrastructure of growth, an area where organizations haven’t invested significantly in the previous five to 10 years. The desire for growth needs to be matched with investments in knowledge, technology, and innovation. We anticipate that 2018 will be a year when service leaders begin to transition into new revenue models.

Voice of the Service Leader

In The Service Council’s annual trends survey of 2017, service leaders indicated that their top initiatives were focused on the improvement of customer management, the enhancement of service operations with the aid of business data, and an expansion of knowledge management across the enterprise. In discussions with service leaders, it seemed like most were looking to get closer to their customers via better voice of the customer and listening initiatives to truly understand what these customers valued. In several industries, we also noted that organizations were balancing the demands and needs of various customers within an organization.

In discussions with service leaders, it seemed like most were looking to get closer to their customers via better voice of the customer and listening initiatives to truly understand what these customers valued. In several industries, we also noted that organizations were balancing the demands and needs of various customers within an organization.

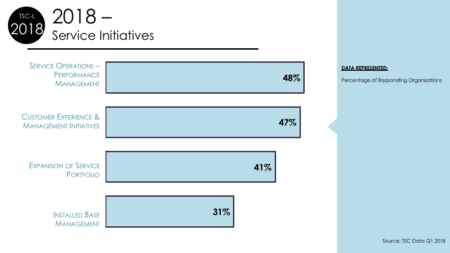

2018 initiatives are similar to those planned for 2017 and we don’t see a major deviation for service leaders. The push is to continue to drive operational efficiencies and business capacity with the aid of data, information and technology. In parallel, organizations are looking to continue to ramp up their customer experience initiatives. As these initiatives get more mature and move from the listening phase to the customer understanding phase, organizations are hoping to use customer insight and data to support revenue generation efforts.

Voice of the customer efforts have been popular for several years and were championed by those in business to consumer industries. In serving a larger number of customers and customer transactions, it was essential for these organizations to get a pulse of customer sentiment tied to service transactions and business relationships. The effort from these organizations was to improve operations to support better loyalty and retention. Some would argue that the intent of these organizations is now shifting to ensuring a greater use of purchased product and service features, akin to the customer success model.

In enterprises that work directly with other businesses, the volume of transactions and interactions might not be as large; nevertheless these interactions can have a high degree of value or impact attached to them. Historically, organizations were happy to capture feedback from their customers, but customer listening wasn’t a prioritized activity. That has changed; as over the last three years we have seen more organizations invest in voice of the customer and customer surveying programs. More so, service leaders have also sought after resources to map customer journeys and identify key pain points in the service delivery ecosystem. These customer experience activities have led to a handful of initiatives that strive to assuage frustrated customers, increase visibility into the service process, and reduce the effort required to access the service organization. We now believe that organizations are fairly well equipped to deal with direct customer feedback but now need to dive deeper to truly unearth customer value.

Deciphering value requires a deeper look at customer feedback. Customer complaints and outreach are typically a channel for customers to share their expressed wishes. Answering expressed needs and wishes is essential to maintaining customer satisfaction, but addressing unexpressed needs is the key to differentiation. This requires the ability for service teams to dig deeper into the reasons for a customer contact and what that specific customer might be looking to accomplish with the delivered information.

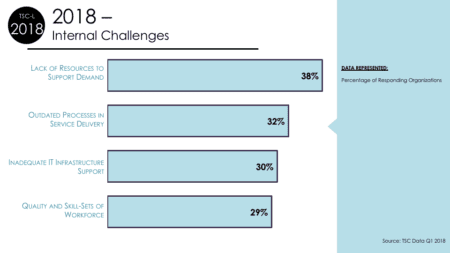

Addressing Constraint

The delivery of improved experiences must occur in a constraint heavy environment. The biggest constraint faced by organizations is the capacity of the service workforce. This capacity isn’t solely tied to the quantity of service tasks that must be met, but in the quality of service interactions that must be supported by service personnel. In organizations with field service groups, there is a major focus on replacing retiring service workers and in retaining and replicating their knowledge for future generations. Several industries are having major issues tapping into the next generation of service workers. Yet service requests continue and customers require a higher level of service.

The delivery of improved experiences must occur in a constraint heavy environment. The biggest constraint faced by organizations is the capacity of the service workforce. This capacity isn’t solely tied to the quantity of service tasks that must be met, but in the quality of service interactions that must be supported by service personnel. In organizations with field service groups, there is a major focus on replacing retiring service workers and in retaining and replicating their knowledge for future generations. Several industries are having major issues tapping into the next generation of service workers. Yet service requests continue and customers require a higher level of service.

Technology might seem like the best answer to addressing capacity issues, but the real solution comes from a better understanding of available service data. This explains why service leaders are looking at their major sources of data to identify:

- Inefficient service delivery processes

- Opportunities for automation and elimination of manual intervention

- Opportunities for enhancement of service worker output and coverage

The data that is available at the service leader’s fingertips can come from multiple sources. It may come direct from the product being serviced, and this mode of data communication continues to gain traction. Yet reliable data is already available from:

- Customer requests, complaints and claims

- Point-of-service systems tracking work completion and resources required

Once operational improvement opportunities are identified, it makes sense to inject technology solutions to address these opportunities. For instance, portals can be created to offer customers an easier path to service information or to the creation of a service request as compared to a traditional 1-800 call queue. Routing technology can be used to directly connect customers to higher-level technical support. Video solutions can allow for assisted service resolution or improved diagnosis prior to dispatch. And just-in-time content can be sent to technicians to ensure that their service visits are successful.

We would recommend that service leaders also analyze and review data tied to the customer experience as much as they use data to prioritize operational improvements. If customers indicate that the ease of access to service personnel is a priority for them, or that other areas in the service delivery ecosystem need improvement, then these could help service leaders rank needed changes.

The Growth Plan

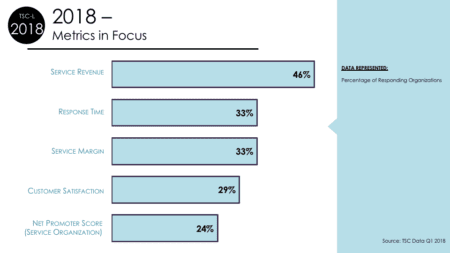

Operational and customer-focused initiatives are being paired with those that focus on business and service revenue. In discussions around service’s impact on the business, TSC has previously highlighted two revenue buckets that are directly enhanced by service.

- Service-Impacted Revenue: Revenue generated as a result of positive customer satisfaction, typically tied to up-sells, cross-sells, renewals, new purchases, and referrals.

- Service Revenue: Revenue generated from the sale of service products such as service parts, time & material work, or service agreements.

In pursuing growth in 2018, service leaders continue to support the first bucket of revenue typically driven by other parts of the organization but are taking aim at enhancing their overall service revenue contribution. This expansion is typically supported in two ways.

- Understanding customer use of current service products

- Uncovering appetite for new service products

For those organizations with service agreements in place, it’s essential to understand which customers are covered by these agreements and which ones are coming up for renewal. Better visibility into coverage and renewal opportunities can uncover millions in revenue opportunities. Once visibility is established, it is essential to identify why customers chose to stay away from service agreements or other products. This might uncover awareness or sales opportunities for the service enterprise.

For those organizations with service agreements in place, it’s essential to understand which customers are covered by these agreements and which ones are coming up for renewal. Better visibility into coverage and renewal opportunities can uncover millions in revenue opportunities. Once visibility is established, it is essential to identify why customers chose to stay away from service agreements or other products. This might uncover awareness or sales opportunities for the service enterprise.

In addition to actual coverage and renewal, service organizations must understand how customers are utilizing products and services. Awareness of customer adoption and usage will allow for improved account management opportunities. It might also yield ideas for net new services that can be valuable to customers.

The Need for Service Innovation

While organizations are navigating what it means to be a digital business, they are also looking to new collaboration models with their customers to ensure longer and more profitable relationships. In innovation-focused research conducted by The Service Council in 2017, less than one-half of organizations highlighted that their service businesses received as much focus on innovation, as did the other parts of the business.

For organizations to be more innovative in service, an internal transformation needs to occur around business leadership, around business measurement, and around the technology in place to support a new service business. Service leaders must develop and fuel a culture that welcomes and accepts new ways of doing business, even at the cost of cannibalizing existing revenue streams. The promise of innovation is ripe at service organizations; it’s now time for service leaders to execute on this promise.

Share this: